Regional Tax Manager Americas

Now Hiring! Regional Tax Manager Americas

We are looking for a Regional Tax Manager Americas to join our Coatings team in Southfield, MI or New Providence, NJ.

Southfield, Michigan

In the Coatings division, we offer far more than just paints and coatings. Our approach is to put the needs of our customers at the center and always think one step ahead. Our motto, “We always go beyond the surface,” makes it clear that we are not only focused on the products themselves, but also on the reasons why we develop them. We are interested in creating innovative solutions that promote future growth and fulfil the requirements of the market. With our extensive knowledge and experience, we work to provide tailored coatings solutions that create real value and build strong partnerships.

Where the chemistry happens…

We are seeking a professional like you to serve as our Regional Tax Manager for the Americas based out of Southfield, MI or New Providence, NJ. Due to a strategic realignment of our Coatings business unit, a dedicated finance department is being established. This presents an exciting opportunity to develop and shape the finance organization from its foundation.

As a Regional Tax Manager Americas, You Create Chemistry By...

- Lead the tax function across the Americas by developing and implementing strategies that optimize tax efficiency and ensure compliance with both local and international tax laws during and after the transition from BASF’s transitional service agreements (TSA).

- Oversee all direct and indirect tax operations, ensuring accurate and timely filings, documentation, and adherence to relevant regulations.

- Collaborate closely with global external tax service providers to ensure a smooth transition to standalone tax operations, facilitating knowledge transfer and maintaining continuity.

- Implement robust risk management practices to mitigate tax-related risks, establish compliance frameworks, and manage tax audits and inquiries.

- Work closely with the Group Tax Director and manage external tax service providers, fostering continuous learning, adaptability, and excellence in tax operations.

- Build and maintain strong relationships with tax authorities, external advisors, and internal stakeholders to facilitate compliance and identify tax optimization opportunities.

- Provide strategic tax advice to senior management, supporting business decisions and enhancing the company’s overall tax position in the region.

If you have...

• An advanced degree in Taxation, Accounting, Finance, Business Administration, or a related field.

• Advanced qualifications such as Certified Public Accountant (CPA) or equivalent (a plus).

• At least 8 years’ experience in tax management, including roles within a multinational corporation or international tax advisors/accounting firm.

• In-depth knowledge of direct and indirect tax laws, and international tax principles is essential.

• Experience in the chemicals industry or related sectors is beneficial, particularly in establishing new finance functions.

• Proficiency in tax software, SAP, and advanced MS Office skills.

• Strong analytical and strategic thinking skills are needed to manage complex tax environments and provide effective solutions.

• Excellent communication and interpersonal skills.

Privacy Statement

BASF takes security & data privacy very seriously. We will never request financial information of any kind via email, private text message or direct message on any social medial platform or job board. Furthermore, we will never send a candidate a check for equipment or request any type of payment during the job application process. If you have experienced any of the above, please contact myhr@basf.com to report fraud.

Pay Transparency

BASF is committed to pay transparency practices. The competitive Pay Range for this role is $170,000 - $210,000. Actual pay will be determined based on education, certifications, experience, and other job-related factors permitted by law.

Equal Employment Opportunities

We are an equal opportunity employer and all qualified applicants will receive consideration for employment without regard to race, age, citizenship, color, religion, sex, marital status, national origin, disability status, gender identity or expression, protected veteran status, or any other characteristic protected by law.

Applicants must be currently authorized to work in the United States on a full-time basis.

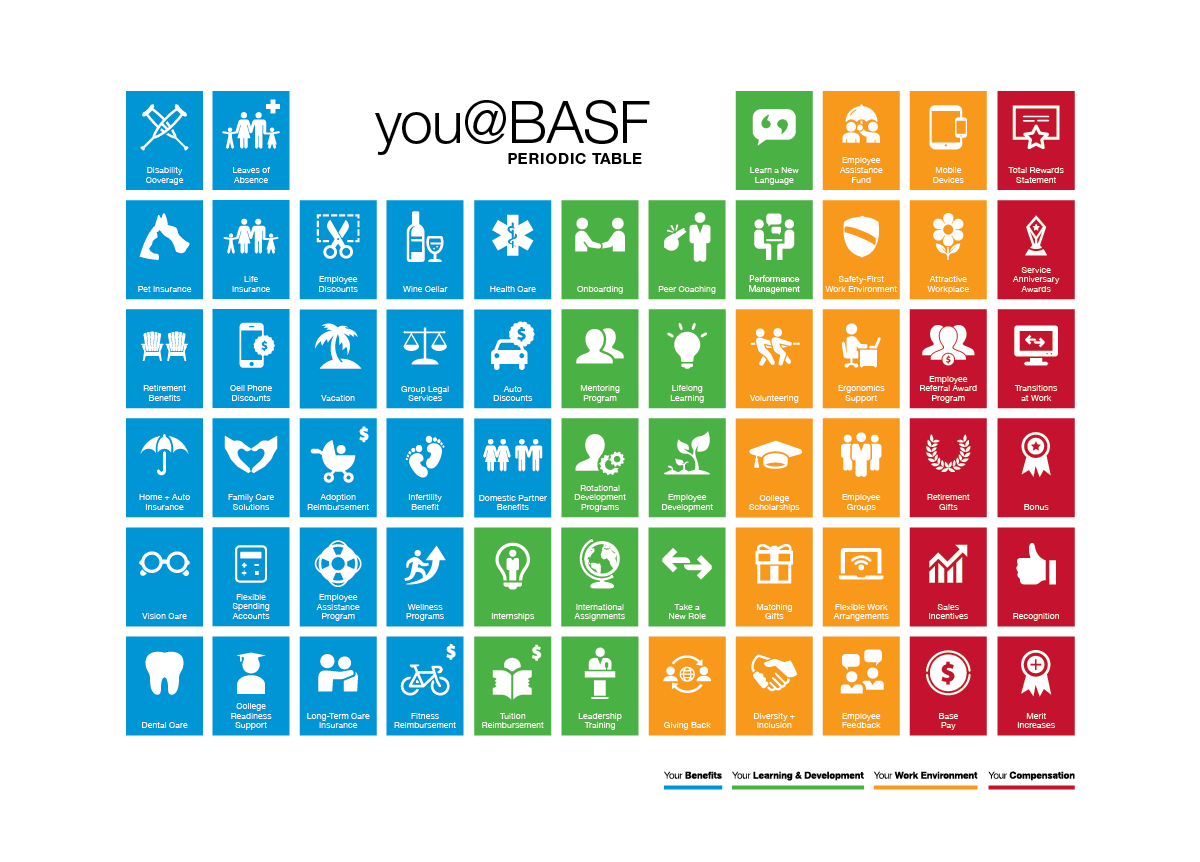

A unique total offer: you@BASF

At BASF you get more than just compensation. Our total offer includes a wide range of elements you need to be your best in every stage of your life. That’s what we call you@BASF. Click here to learn more.

A unique total offer: you@BASF

At BASF you get more than just compensation. Our total offer includes a wide range of elements you need to be your best in every stage of your life. That’s what we call you@BASF. Click here to learn more.

At BASF, we believe that people are the key to our long-term success and that talent is in everyone.

We thrive on giving you the support you need to be your best and fulfil personal ambitions…that’s how we create chemistry. #belongatBASF

Your application

Here you find anything you need to know about your application and the application process.

Contact us

You have questions about your application or on how to apply in Europe? The BASF Talent Acquisition Europe team is glad to assist you.

Please note that we do not return paper applications including folders. Please submit copies only and no original documents.

Southfield, MI, US, 48033-2442 New Providence, NJ, US, 07974