Supervisor, Tax(007074)

• Ensuring Compliance with Transfer Pricing Regulations: Ensuring that all intercompany transactions comply with the arm's length principle, meaning they should be priced as if the transactions were between unrelated parties. This involves setting transfer prices that reflect market conditions and ensuring documentation meets regulatory standards.

• Managing Intercompany Transactions: Overseeing the pricing of goods exchanged between different legal entities within EC & ensuring that they are conducted at appropriate transfer prices.

• Supporting Business Units: Providing guidance to business units on transfer pricing matters, helping them understand the impact of transfer pricing on profitability and compliance. This includes advising on the allocation of costs and revenues across different parts of the organization.

• Documentation and Reporting: Maintaining detailed documentation of transfer pricing policies and practices is crucial. Ensuring that all necessary documentation is in place to support the transfer pricing strategy and to respond to audits or inquiries from tax authorities.

• Strategic Planning and Analysis: The role involves analyzing the financial impact of transfer pricing strategies and making recommendations to optimize tax efficiency and business performance. This includes evaluating the effects of transfer pricing on the consolidated financial statements of EC.

= Main Tasks =

Functional Tasks (Inclusive but not limited):

• Develop, implement, and monitor transfer pricing policies to comply with local and international regulations.

• Conduct detailed financial and economic analyses to support intercompany pricing strategies.

• Prepare and maintain transfer pricing documentation, including master and local files in line with OECD guidelines.

• Collaborate with finance, tax, and legal departments to ensure strategic alignment.

• Support audits and manage relationships with tax authorities on transfer pricing matters.

• Stay updated on international transfer pricing regulations and their organizational impact.

• Provide strategic advice to management on transfer pricing.

• Utilize advanced SAP tools for pricing calculations, monitoring, and recommendations

= Job Requirements =

• Bachelor’s degree in Taxation, Finance, Economics, or a related field; a master’s degree or relevant certification (e.g., CPA, CMA, CFA) is a plus

• experience in transfer pricing, taxation, or related fields, preferably within a multinational environment are beneficial

• Experience in the chemicals industry or related sectors is beneficial

• Strong understanding of OECD guidelines and local transfer pricing regulations are beneficial

• Proficiency in tax software, SAP, and advanced Microsoft Office skills are beneficial

• Excellent analytical and problem-solving skills, with the ability to interpret and communicate complex tax concepts effectively

• Proficiency in English, with strong interpersonal skills for effective communication

请时刻警惕任何可能的招聘欺诈行为!请注意,巴斯夫绝不会在任何情况下向候选人以任何形式收取任何费用。

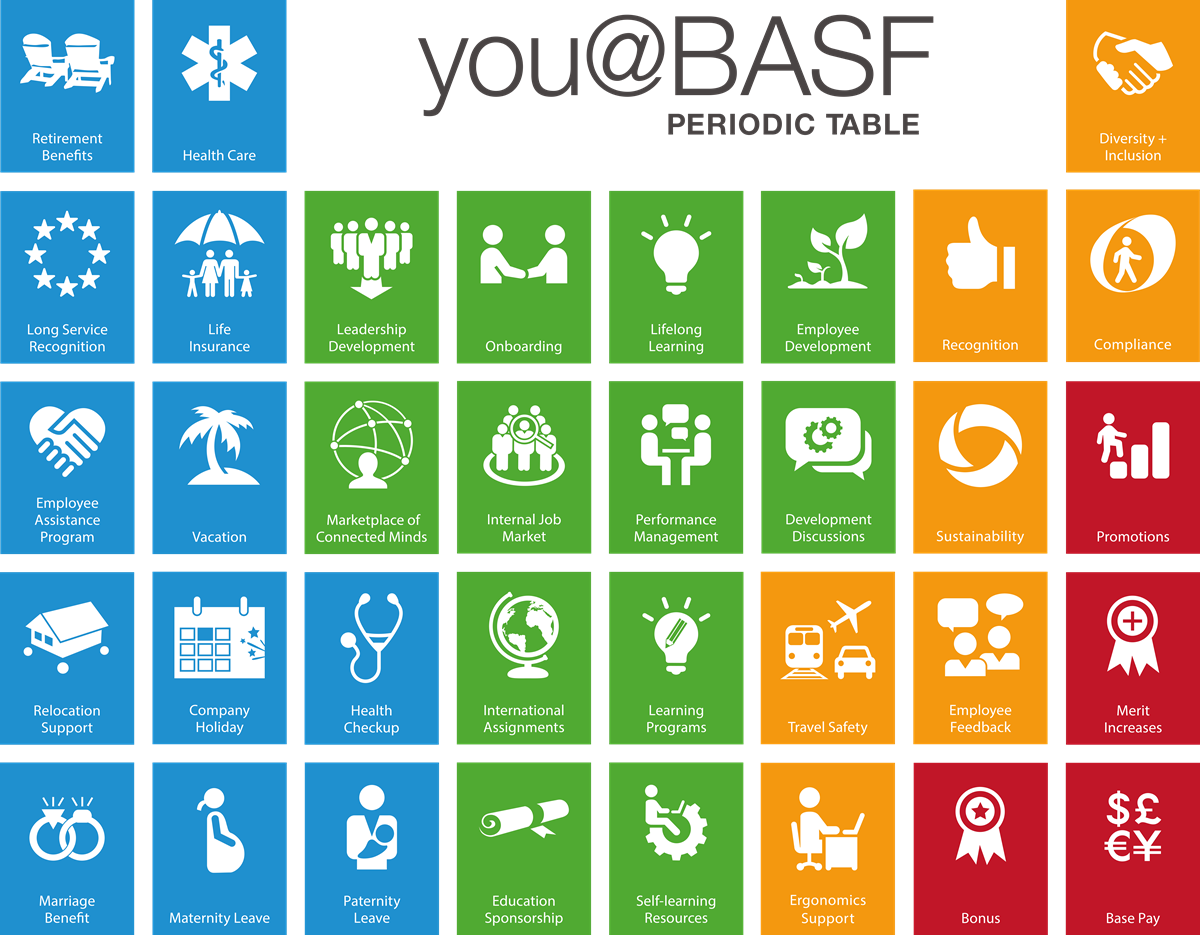

A unique total offer: you@BASF

At BASF you get more than just compensation. Our total offer includes a wide range of elements you need to be your best in every stage of your life. That’s what we call you@BASF. Click here to learn more.

A unique total offer: you@BASF

At BASF you get more than just compensation. Our total offer includes a wide range of elements you need to be your best in every stage of your life. That’s what we call you@BASF. Click here to learn more.

Working at BASF: We connect to create chemistry

We are proud of strong history of innovation, which has helped make us who we are today – the world's leading chemical company. Every day, our global team of over 120,000 individuals work together to turn visions for sustainable solutions into reality by connecting with one another and sharing our knowledge.

The right people are crucial for our sustainable success. We aim to form the best team by bringing together people with unique backgrounds, experiences and points of view. Our differences make us stronger and more vibrant. And an open, creative and supportive work environment inspires us to achieve exceptional results.

Your application

Here you find anything you need to know about your application and the application process.

Contact us

You have questions about your application or on how to apply in Europe? The BASF Talent Acquisition Europe team is glad to assist you.

Please note that we do not return paper applications including folders. Please submit copies only and no original documents.

SHANGHAI,CN,200000